Not everyone felt the way urbanites did.doc_loliday wrote: Wed May 19, 2021 1:39 pmC-Mag wrote: Wed May 19, 2021 12:58 pmAgreed.GloryofGreece wrote: Wed May 19, 2021 12:35 pm The "America" most people think of when they conjure up some sort of Americana is what pretty much only existed from roughly 1920-1965ish.

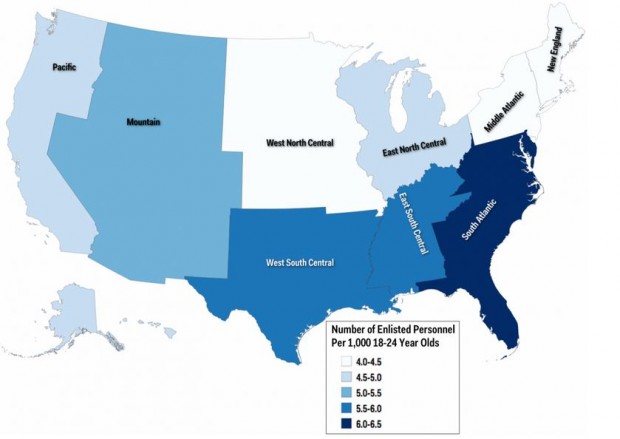

Another shortage right now, that is going to get worse is recruitment and retention in the military. The military has a shortage right now, and the Woke policies are going to make it worse. The current military is derived largely from Red States. Further, a study found, 80 percent of recruits come from areas that have a rural concentration of less than 0.5, meaning that they come from areas where more than half of the population is urbanized.*

I know veterans who are telling their kids not to join the military. What percentage of rural and red state folks stop going into the military before it's completely broken ?

Chad and Bubba don't want to serve in the Army of Emma.

*

https://www.heritage.org/defense/report ... -after-911

I wonder if the next time some ultra blue city is terror attacked if rural America will feel the same way they did after 9/11.

Supply Chain Shortages and Inflation

-

SuburbanFarmer

- Posts: 25477

- Joined: Wed Nov 30, 2016 6:50 am

- Location: Ohio

Re: Supply Chain Shortages and Inflation

-

C-Mag

- Posts: 28389

- Joined: Tue Nov 29, 2016 10:48 pm

Re: Supply Chain Shortages and Inflation

Current real inflation rate 11%

Economist John Williams, founder of ShadowStats.com, says the Federal Reserve has painted itself into such a tight corner with the economy it really has only two choices. Williams says it comes down to “Inflation or Implosion.” What would happen to the financial system if the Fed stopped printing massive amounts of money for stimulus and debt service? Williams explains, “You could see financial implosion by preventing liquidity being put into the system. The system needs liquidity (freshly created dollars) to function. Without that liquidity, you would see more of an economic implosion than you have already seen. In fact, I will contend that the headline pandemic numbers have actually been a lot worse than they have been reporting. It also means we are not recovering quite as quickly. The Fed needs to keep the banking system afloat. They want to keep the economy afloat. All that requires a tremendous influx of liquidity in these difficult times.”

So, is the choice inflation or implosion? Williams says, “That’s the choice, and I think we are going to have a combination of both of them. I think we are eventually headed into a hyperinflationary economic collapse. It’s not that we haven’t been in an economic collapse already, we are coming back some now. . . . The Fed has been creating money at a pace that has never been seen before. You are basically up 75% (in money creation) year over year. This is unprecedented. Normally, it might be up 1% or 2% year over year. The exploding money supply will lead to inflation. I am not saying we are going to get to 75% inflation—yet, but you are getting up to the 4% or 5% range, and you are soon going to be seeing 10% range year over year. . . . The Fed has lost control of inflation.”

And remember, when the Fed has to admit the official inflation rate is 10%, John Williams says, “When they have to admit the inflation rate is 10%, my number is going to be up to around 15% or higher. My number rides on top of their number.”

Right now, the Shadowstat.com inflation rate is above 11%.

. . .

When will the worst inflation be hitting America? Williams predicts, “I am looking down the road, and in early 2022, I am looking for something close to a hyperinflationary circumstance and effectively a collapsed economy.”

https://bayourenaissanceman.blogspot.co ... ts-on.html

Economist John Williams, founder of ShadowStats.com, says the Federal Reserve has painted itself into such a tight corner with the economy it really has only two choices. Williams says it comes down to “Inflation or Implosion.” What would happen to the financial system if the Fed stopped printing massive amounts of money for stimulus and debt service? Williams explains, “You could see financial implosion by preventing liquidity being put into the system. The system needs liquidity (freshly created dollars) to function. Without that liquidity, you would see more of an economic implosion than you have already seen. In fact, I will contend that the headline pandemic numbers have actually been a lot worse than they have been reporting. It also means we are not recovering quite as quickly. The Fed needs to keep the banking system afloat. They want to keep the economy afloat. All that requires a tremendous influx of liquidity in these difficult times.”

So, is the choice inflation or implosion? Williams says, “That’s the choice, and I think we are going to have a combination of both of them. I think we are eventually headed into a hyperinflationary economic collapse. It’s not that we haven’t been in an economic collapse already, we are coming back some now. . . . The Fed has been creating money at a pace that has never been seen before. You are basically up 75% (in money creation) year over year. This is unprecedented. Normally, it might be up 1% or 2% year over year. The exploding money supply will lead to inflation. I am not saying we are going to get to 75% inflation—yet, but you are getting up to the 4% or 5% range, and you are soon going to be seeing 10% range year over year. . . . The Fed has lost control of inflation.”

And remember, when the Fed has to admit the official inflation rate is 10%, John Williams says, “When they have to admit the inflation rate is 10%, my number is going to be up to around 15% or higher. My number rides on top of their number.”

Right now, the Shadowstat.com inflation rate is above 11%.

. . .

When will the worst inflation be hitting America? Williams predicts, “I am looking down the road, and in early 2022, I am looking for something close to a hyperinflationary circumstance and effectively a collapsed economy.”

https://bayourenaissanceman.blogspot.co ... ts-on.html

PLATA O PLOMO

Don't fear authority, Fear Obedience

Don't fear authority, Fear Obedience

-

Fife

- Posts: 15157

- Joined: Wed Nov 30, 2016 9:47 am

Re: Supply Chain Shortages and Inflation

If the normies only knew how bad it really is:

The inflation economy

"Money is a store of value, not a yardstick of pleasure."

The inflation economy

"Money is a store of value, not a yardstick of pleasure."

This actually helps us discuss inflation—with the equanimity of the cancer patient who knows his only option is philosophy. We are not here to criticize the inflation economy. Were I on the Federal Reserve Board—seated as cardinal, at the high altar of America’s high temple of inflation—I should concur with my fellow hierophants. There can be no reasonable dissent from inflation. There is no reasonable alternative.

-

C-Mag

- Posts: 28389

- Joined: Tue Nov 29, 2016 10:48 pm

Re: Supply Chain Shortages and Inflation

Fife wrote: Tue May 25, 2021 8:14 am If the normies only knew how bad it really is:

The inflation economy

"Money is a store of value, not a yardstick of pleasure."

This actually helps us discuss inflation—with the equanimity of the cancer patient who knows his only option is philosophy. We are not here to criticize the inflation economy. Were I on the Federal Reserve Board—seated as cardinal, at the high altar of America’s high temple of inflation—I should concur with my fellow hierophants. There can be no reasonable dissent from inflation. There is no reasonable alternative.

I gave it a pompous, catchy name, like “Modern Inflation Theory” (MIT).

“Inflation is always and everywhere a monetary phenomenon.” This is MIT’s elevator pitch. Milton Friedman said it 50 years ago and it is still true.

Crash course in inflation: inflation is two things, A and B. A and B are both bad. B is obviously bad. A is subtly bad. A causes B. A also causes other things. In theory, other things can cause B. In practice, B almost always involves A.

I still remember the first couple years of the Reagan admin. When he inherited the vibrant economy left by Jimmy Carter, the inflation rate was 15% and a home mortgage was 18%. The vintage press would do these wo is me stories about middle class families having to have spaghetti 5 nights a week because it was the cheapest thing they could make. No inflation is good.

PLATA O PLOMO

Don't fear authority, Fear Obedience

Don't fear authority, Fear Obedience

-

DBTrek

- Posts: 12241

- Joined: Wed Jan 25, 2017 7:04 pm

Re: Supply Chain Shortages and Inflation

Inflation ain't so bad on the mortgage payment. When a loaf of bread is the same as your mortgage, you're effectively paying the bank one loaf of bread a month for your house.

But that's also why the government and Federal Reserve are all but sure to rein it in at some point. Bankers want more than a loaf of bread every month for your house. And when those measure go in to "stop" inflation .... like those double digit interest rates - yeeeeeeeeeeesh. You think people are complainy-pants now. Wait till the free ride funds are reduced.

But that's also why the government and Federal Reserve are all but sure to rein it in at some point. Bankers want more than a loaf of bread every month for your house. And when those measure go in to "stop" inflation .... like those double digit interest rates - yeeeeeeeeeeesh. You think people are complainy-pants now. Wait till the free ride funds are reduced.

"Hey varmints, don't mess with a guy that's riding a buffalo"

-

C-Mag

- Posts: 28389

- Joined: Tue Nov 29, 2016 10:48 pm

Re: Supply Chain Shortages and Inflation

Provided your wages go up to match the cost of a price of bread to pay your mortgage with.DBTrek wrote: Tue May 25, 2021 8:44 am Inflation ain't so bad on the mortgage payment. When a loaf of bread is the same as your mortgage, you're effectively paying the bank one loaf of bread a month for your house.

But that's also why the government and Federal Reserve are all but sure to rein it in at some point. Bankers want more than a loaf of bread every month for your house. And when those measure go in to "stop" inflation .... like those double digit interest rates - yeeeeeeeeeeesh. You think people are complainy-pants now. Wait till the free ride funds are reduced.

PLATA O PLOMO

Don't fear authority, Fear Obedience

Don't fear authority, Fear Obedience

-

Martin Hash

- Posts: 19225

- Joined: Wed Jan 20, 2010 2:02 pm

Re: Supply Chain Shortages and Inflation

Inflation is a transfer of wealth from the unproductive to the productive: wages will go up with inflation.

Shamedia, Shamdemic, Shamucation, Shamlection, Shamconomy & Shamate Change

-

C-Mag

- Posts: 28389

- Joined: Tue Nov 29, 2016 10:48 pm

Re: Supply Chain Shortages and Inflation

That's quoteable.Martin Hash wrote: Tue May 25, 2021 9:23 am Inflation is a transfer of wealth from the unproductive to the productive: wages will go up with inflation.

The current real inflation rate is 11% per shadowstats. Say we have a inflation rate up to 15%. When do you see wages increasing and when.

PLATA O PLOMO

Don't fear authority, Fear Obedience

Don't fear authority, Fear Obedience

-

Martin Hash

- Posts: 19225

- Joined: Wed Jan 20, 2010 2:02 pm

Re: Supply Chain Shortages and Inflation

Right now the zombies still believe everything is great now that Trump's gone. It's going to take awhile before they acknowledge anything is amiss. Certainly employers aren't going to raise wages until workers demand it so I don't see it happening this year. My zombie former-friends won't even admit anything is possibly wrong, the opposite in fact, they think nirvana on earth has arrived. Just ask Hanny, he's probably been shoplifting all morning.C-Mag wrote: Tue May 25, 2021 9:57 amThat's quoteable.Martin Hash wrote: Tue May 25, 2021 9:23 am Inflation is a transfer of wealth from the unproductive to the productive: wages will go up with inflation.

The current real inflation rate is 11% per shadowstats. Say we have a inflation rate up to 15%. When do you see wages increasing and when.

Shamedia, Shamdemic, Shamucation, Shamlection, Shamconomy & Shamate Change

-

The Conservative

- Posts: 14812

- Joined: Wed Nov 30, 2016 9:43 am

Re: Supply Chain Shortages and Inflation

I wonder what is going to happen when they realize the apple they have bitten into has worms in it.Martin Hash wrote: Tue May 25, 2021 10:09 amRight now the zombies still believe everything is great now that Trump's gone. It's going to take awhile before they acknowledge anything is amiss. Certainly employers aren't going to raise wages until workers demand it so I don't see it happening this year. My zombie former-friends won't even admit anything is possibly wrong, the opposite in fact, they think nirvana on earth has arrived. Just ask Hanny, he's probably been shoplifting all morning.C-Mag wrote: Tue May 25, 2021 9:57 amThat's quoteable.Martin Hash wrote: Tue May 25, 2021 9:23 am Inflation is a transfer of wealth from the unproductive to the productive: wages will go up with inflation.

The current real inflation rate is 11% per shadowstats. Say we have a inflation rate up to 15%. When do you see wages increasing and when.

#NotOneRedCent