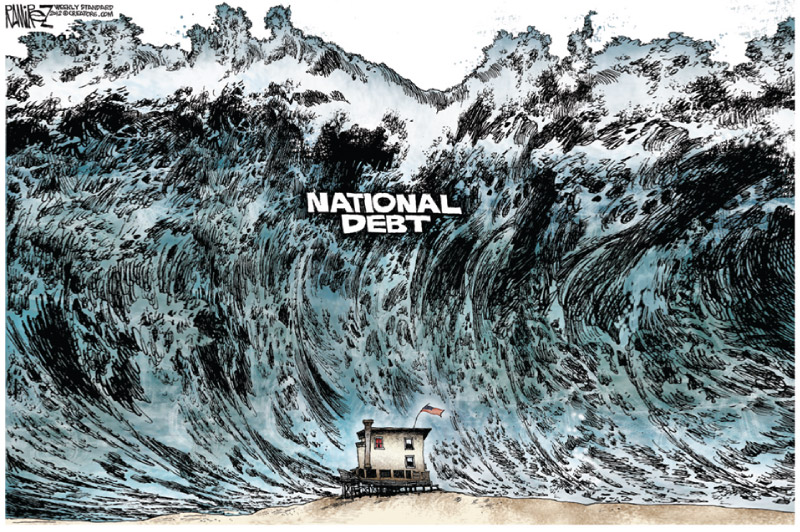

The National Debt Thread

-

Zlaxer

- Posts: 5377

- Joined: Fri Dec 02, 2016 5:04 am

The National Debt Thread

https://nationalpost.com/news/the-utter ... -right-now

20T...and accelerating....

Can an economic liberal please explain why they think this is sustainable? I really don't see how...right now, fear is what keeps it together....fear that not trading in dollars will collapse the system...but at some point...it has to stop...I mean, we can't have an annual deficit higher than the GDP for the entire history of the country, can we? Cuz that we're we are headed.... Right now, there isn't enough gold on the entire planet to pay off the US debt....

20T...and accelerating....

Can an economic liberal please explain why they think this is sustainable? I really don't see how...right now, fear is what keeps it together....fear that not trading in dollars will collapse the system...but at some point...it has to stop...I mean, we can't have an annual deficit higher than the GDP for the entire history of the country, can we? Cuz that we're we are headed.... Right now, there isn't enough gold on the entire planet to pay off the US debt....

-

Zlaxer

- Posts: 5377

- Joined: Fri Dec 02, 2016 5:04 am

Re: The National Debt Thread

Is there anyone here who believes the US's spending can continue indefinitely? If not, does anyone have a best guess as to when shit hits the fan?

-

SuburbanFarmer

- Posts: 25278

- Joined: Wed Nov 30, 2016 6:50 am

- Location: Ohio

Re: The National Debt Thread

A few months ago was the last chance to let it land, but they yanked the stick again. We are currently stalling before The Plunge.

I give it a month.

If you’re looking for remaining Beliebers, look to the Boomers. They made this, and they still think it’s going to work - or they’re counting on dying off before it happens, because fuck everybody.

See: our benevolent host.

-

brewster

- Posts: 1848

- Joined: Tue Dec 06, 2016 6:33 pm

Re: The National Debt Thread

There's an easy 'answer', that govt debt is not the same as household debt, a household can't control the interest rates and inflation of your economic environment. Then there's the hard answers that professional economists argue about without resolution. Read up on Modern Economic Theory if you want your head to explode. It all revolves around inflation and what causes it. No one has a complete answer, surely not AOC, who is barely literate as far as I'm concerned. According to the Austrians we should have been in deep inflationary trouble long ago. I read something about how issuing debt is less inflationary than printing cash.

Here's blog I just ran across, I can barely tell which side he's on!

Http://bilbo.economicoutlook.net/blog/?p=41547

I hope your thread does'n't go down the toilet with the usual namecalling and TV talking points. Most economic discussions end in accusations that the other guy is ignoring data showing the failure of his system.

Here's blog I just ran across, I can barely tell which side he's on!

Http://bilbo.economicoutlook.net/blog/?p=41547

I hope your thread does'n't go down the toilet with the usual namecalling and TV talking points. Most economic discussions end in accusations that the other guy is ignoring data showing the failure of his system.

We are only accustomed to dealing with like twenty online personas at a time so when we only have about ten people some people have to be strawmanned in order to advance our same relative go nowhere nonsense positions. -TheReal_ND

-

pineapplemike

- Posts: 4650

- Joined: Wed Nov 30, 2016 5:34 pm

Re: The National Debt Thread

Worrying About Deficits Falls Out of Style

The widening federal budget deficit has yet to result in economic calamity, but as more money goes to interest payments on debt, less is available for things like infrastructure, schools and social benefits

https://www.wsj.com/articles/worrying-a ... 1550503956

Feb. 18, 2019

It’s no longer cool to talk about the federal budget deficit. (was it ever?)

Nary a word about the budget deficit passed President Trump’s lips during his 82-minute State of the Union address this month. Nor was it mentioned by Stacey Abrams, the rising Georgia political star, in her Democratic response.

All told, Washington’s red-ink alarms have gone dead, even though the annual deficit will reach roughly $900 billion this year, then pass the trillion-dollar mark annually starting in 2022. The accumulated public debt just surpassed $22 trillion.

The question is: Is this lack of concern wise?

Certainly the political constituency for deficit reduction is evaporating. Conservatives see deficit talk as a not-so-hidden ploy to roll back tax cuts, and an attempt to blame President Trump for all the red ink. Liberals see deficit talk as a not-so-hidden ploy to justify cutting Medicare, Medicaid and Social Security.

Indeed, in an important new essay in Foreign Affairs magazine, two Democrats, former National Economic Council head Jason Furman and former Treasury Secretary Lawrence Summers, argue explicitly against focusing on deficit reduction.

Concern about deficits, they say, limits government investments in education, health care and infrastructure, all of which do more to help the economy in the long run than does deficit reduction. “Politicians and policy makers should focus on urgent social problems, not deficits,” they write.

They aren’t advocating ignoring fiscal constraints entirely. Instead, they argue that while budget writers need not worry about reducing deficits, they should take a path that ensures new spending and tax cuts don’t add more to deficit spending.

“This middle course would tolerate large and growing deficits without making a major effort to reduce them—at least for the foreseeable future,” they say. “But it would also stop the policy trend of the last two years, which will otherwise continue to pile up debt.”

One of the reasons deficit concerns are low is that the country has been living with big federal deficits for a long while now, and the economic calamity some predicted has never materialized.

In fact, the economy has been on a long, steady growth curve as deficits have risen. In the broader economy, government borrowing hasn’t crowded out other investments, at least not in a big way. The alarmist predictions haven’t come to pass.

But, wait: Actually, harm is being done.

The macroeconomic effects of today’s deficits are blunted because money continues to roll in from overseas to finance American debt. Yet that also means that some of America’s domestic economic output heads overseas in debt payments. “Increasingly, what is our domestic production is not our domestic income,” says Douglas Holtz-Eakin, former head of the Congressional Budget Office and of the White House Council of Economic Advisers. “It is flowing overseas.”

More immediately, Americans are paying an implicit price within the federal budget. As the nation’s accumulated debt rises—and the federal debt held by the public will reach 93% of America’s gross domestic product by 2029, its highest level since just after World War II—the bill to pay the interest on that debt rises too.

The federal government has to pay that interest; that’s not optional. And as more of the federal budget goes to interest payments, less money is available for other government programs: infrastructure, schools, social benefits.

This interest expense is going to keep rising as the debt keeps piling up. The Committee for a Responsible Federal Budget, a nonpartisan watchdog group, says annual interest payments will nearly triple to $928 billion by 2029, from $325 billion last year. The federal government, it says, will spend more on interest than on Medicaid or on children by next year. By 2024, interest payments will match military spending.

This budget crowding-out affect has been muted somewhat by a period of exceptionally low interest rates. But that won’t be the case forever. Indeed, if interest rates rise one point higher than projected, the cost to the federal budget will be an extra $1.9 trillion over a 10-year period, the CRFB says.

Mr. Furman argues, though, that the budget crowding out would be worse if budget writers tried to devote resources to debt reduction.

Still, even he and Mr. Summers, in their new article, write that those who express no concern at all about rising debt levels are ignoring macroeconomic risks, including debt-driven overstimulation: “Although the U.S. government will remain solvent for the foreseeable future, it would be imprudent to allow the debt-to-GDP ratio to rise forever in an uncertain world. Trying to make this situation sustainable without adjusting fiscal policy or raising interest rates, as recommended by some advocates of modern monetary theory, is a recipe for hyperinflation.”

-

C-Mag

- Posts: 28305

- Joined: Tue Nov 29, 2016 10:48 pm

Re: The National Debt Thread

Don't know where your money is going and why you are in debt...………………. ?

Step One: Get on a Fucking Budget

Step One: Get on a Fucking Budget

PLATA O PLOMO

Don't fear authority, Fear Obedience

Don't fear authority, Fear Obedience

-

brewster

- Posts: 1848

- Joined: Tue Dec 06, 2016 6:33 pm

Re: The National Debt Thread

And if you're already in debt, don't quit your job to wait tables and try acting, hoping you'll be discovered and be able to pay it off. That's essentially what budget cuts without spending cuts is.

National Bureau of Economic Research found that only 17 percent of the revenue from income tax cuts was regained. It also found that 50 percent of the revenue from corporate tax cuts was lost.

https://www.nber.org/digest/jul05/w11000.html

We are only accustomed to dealing with like twenty online personas at a time so when we only have about ten people some people have to be strawmanned in order to advance our same relative go nowhere nonsense positions. -TheReal_ND

-

Martin Hash

- Posts: 18720

- Joined: Wed Jan 20, 2010 2:02 pm

Re: The National Debt Thread

As long as production equals consumption, the Debt is immaterial.

Shamedia, Shamdemic, Shamucation, Shamlection, Shamconomy & Shamate Change

-

Martin Hash

- Posts: 18720

- Joined: Wed Jan 20, 2010 2:02 pm

Re: The National Debt Thread

Printing money just makes rich people richer. Who the fuck cares?

Shamedia, Shamdemic, Shamucation, Shamlection, Shamconomy & Shamate Change

-

SuburbanFarmer

- Posts: 25278

- Joined: Wed Nov 30, 2016 6:50 am

- Location: Ohio

Re: The National Debt Thread

5 years in, and that still makes zero sense. Our production is nowhere in the ballpark of our consumption.Martin Hash wrote: ↑Mon Feb 18, 2019 10:23 pmAs long as production equals consumption, the Debt is immaterial.

Boomer Logic.