Makes sense to me.Cheap credit--newly issued money that can be borrowed at low rates of interest--is presented as the savior of our economic system, but in reality, it's why our system is broken. The conventional economic pitch goes like this: cheap credit enables consumers to buy more goods and services (and since the system needs growth or it implodes, that's good).

Cheap credit also enables companies to invest in new productive assets (capital).

Last but not least, low rates of interest enables the government at all levels to borrow money at relatively low cost.

That all sounds good in theory, but let's see how cheap credit works in the real world.

The first thing we observe is those closest to the central bank credit spigot get the lowest rates and nearly unlimited lines of credit. J.Q. Citizen may be thrilled to get a 4% annual-rate mortgage, but the mega-millionaire closer to the credit spigot can borrow 10 times as much as J.Q. can, and at half the rate of interest.

Mega-corporations and financiers can borrow billions at rates as low as 1%, which given an official inflation rate of 2%, is actually a negative rate of real interest.

Money-center banks own the credit spigot, so they can create money out of thin air at .5%.

In other words, cash isn't king in this perverse system: cheap credit is king. Those with access to cheap unlimited credit can scoop up all the productive assets, greatly increasing their wealth--and they can buy the political class, too, with campaign contributions and donations to false-front foundations.

Here's an example of the perverse incentives and unintended consequences this unlimited credit unleashes in the real economy. Let's say I'm a financier who is close to the credit spigot. I borrow $100 million at 1.25% (or sell $100 million in bonds yielding 1.25%) to buy a company that yields 4.25% in after-tax profits.

Buying the $100 million company costs me nothing but the monthly interest payments. Since the company yields 4.25%, I am already netting a 3% return.

But why settle for a meager annual income of $3 million for doing absolutely nothing? If I sell 80% of the company to pension funds and other institutions for $100 million, I can pay off the $100 million I borrowed to buy the company and keep the 20% I now own free and clear. This transaction nets me $20 million profit for doing nothing but leveraging my access to cheap credit to buy real assets.

If I hold my $20 million stake, it earns a hefty $850,000 annually--once again, for doing nothing but accessing cheap unlimited credit.

In other words--anyone who can borrow $100 million at low rates of interest is instantly wealthy because they can outbid everyone who has to pay higher rates to buy productive real assets.

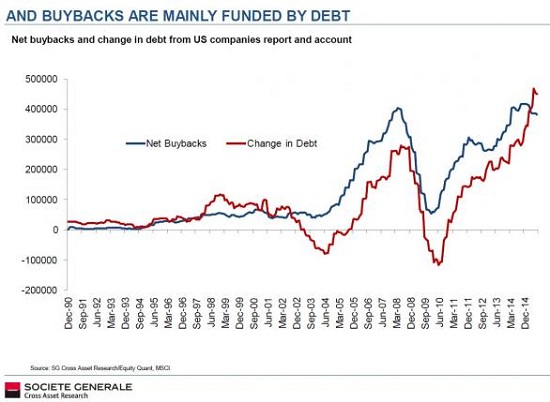

This is why our system is broken: cheap credit has enabled the rich to become immensely richer while producing nothing of value--no additional goods or services have been produced by these financier skims. My example is just one example of many such skims: corporations borrowing billions on the bond market to buy back shares is another.

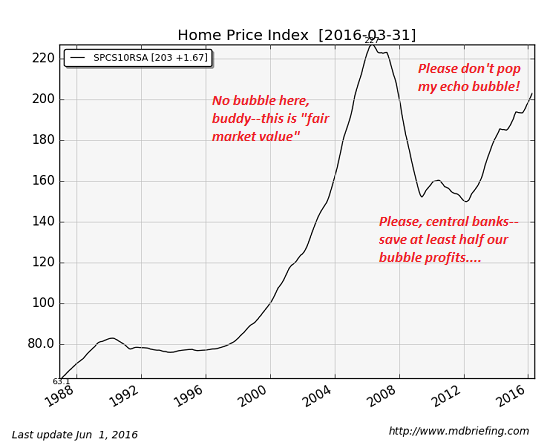

Compare J.Q. Public's struggle to buy a home with the ease of financiers buying hundreds of homes. After years of scrimping and saving, J. and Suzy Q. have saved up the 20% needed to buy a $200,000 home with 20% down ($40,000). Careful analysis of local rents and other methods of valuing housing suggest the house would be a bargain at $180,000 and a bit rich at $220,000--above that, it isn't worth buying as the costs of the mortgage are too high compared to the rent that the house would fetch.

The financier with $100 million in cheap credit has no such difficulties. He doesn't need any cash down--he borrows $100 million from a money center bank or from the bond market. Since his borrowing costs are half of J. Suzy Q's mortgage expenses, he can bid $250,000 for the home, blowing J. and Suzy completely out of the bidding.

And since the financier knows the central banks are busy spewing trillions in new cheap credit to those closest to the credit spigot, he knows he can flip the house to another institutional owner for a hefty profit. Cheap unlimited credit inflates asset bubbles, which benefit those who bought the assets cheap with cheap borrowed credit.

So the house is sold for $350,000 a few years later to an institutional buyer. J. and Suzy Q. are now completely priced out of the market; they now need $70,000 down, and they remain at a disadvantage because their mortgage has a much higher rate than the debt of the financiers who are competing with them.

Cheap unlimited credit for financiers and corporations has incentivized parasitic, zero-productive churning of credit and capital and inflated bubbles that enriched the wealthy. Sure, the top 5% who own stocks, shares of enterprises and homes in left and right-coast hot-spots have done very, very well for themselves--but nowhere near as well as those at the top who have leveraged cheap unlimited credit into billions in risk-free profits.

You want to fix the economic system, reduce political bribery and reduce rising income inequality? Shut off the cheap unlimited credit spigot to banks, financiers and corporations. If everyone with good credit had to pay 6% to borrow money, regardless of their position in the wealth-power pyramid, perverse incentives for parasitic skimming would take a major hit.

Cheap Credit

-

Ex-California

- Posts: 4116

- Joined: Tue Nov 29, 2016 11:37 pm

Cheap Credit

No man's life, liberty, or property are safe while the legislature is in session

-

PartyOf5

- Posts: 3657

- Joined: Fri Dec 02, 2016 11:15 am

Re: Cheap Credit

I agree. Now who's going to do that?

-

SuburbanFarmer

- Posts: 25440

- Joined: Wed Nov 30, 2016 6:50 am

- Location: Ohio

Re: Cheap Credit

Excellent post. Well done, sir.

-

apeman

- Posts: 1566

- Joined: Wed Nov 30, 2016 9:33 am

Re: Cheap Credit

Just saw this, want to add my agreement.

I remember someone started a "how to get rich on Trump" thread, I have the answer now (I've had if for weeks): everyone says its a new era of strong dollar, I say invest under the assumption that the dollar will weaken instead.

I did this just to be a contrarian, it has been my best investment bet ever so far.

I remember someone started a "how to get rich on Trump" thread, I have the answer now (I've had if for weeks): everyone says its a new era of strong dollar, I say invest under the assumption that the dollar will weaken instead.

I did this just to be a contrarian, it has been my best investment bet ever so far.

-

atanamis

- Posts: 64

- Joined: Fri Dec 02, 2016 9:29 am

Re: Cheap Credit

Yeah, I am in total agreement. The fact is that there was wealth destruction in 2008-2010, and it wasn't because house prices fell. It was because banks deliberately allowed real estate that they had foreclosed on to fall apart in disrepair rather than sell it at market rates. This was real wealth destruction because it represented real goods which could have helped house the homeless or provided better housing to renters to get destroyed to help prop up the value of mortgages held by banks, which held only speculative value. Real value comes only from things which provide actual utility to real people. The accumulation of trade goods (such as currency) or investments (including savings) are speculative, accrued based on a hope that they will provide in the future some real value. The housing bubble of 2008 was prevented from fully deflating by government and bank manipulation, and is now re-inflating. As a result, fewer people have houses and those who do had to spend more for those houses than they should have. But since most people with money HAVE a house, and don't want it to drop in price, all of the power is on the side of preserving the system. Much in the same way that home interest tax deductions are a giveaway to the upper middle class, government manipulation of home prices is designed to preserve the power of those who have it at the expense of those who do not.

-

jbird4049

- Posts: 1117

- Joined: Wed Nov 30, 2016 8:56 pm

Re: Cheap Credit

Good post. Just incomplete. I'm on my cell so I can't give it the attention it should get.

These are not normal times.

In the past governments could get more money into the crashing system by.

reducing taxes,

increasing spending on infrastructure,

or print for the banks to loan it out a lot and cheap

Then people/businesses invest, recession leaves hopefully.

Until 2008. Things changed.

The wealthy, and if corporations have been paying everless taxes seriously starting in the 1980s, income for most are flat at best, reversing for many ( if one has a job ), so no money by tax cuts.

Banks don't do 5% anymore they give out credit cards at 30% and hoard new money for stock buybacks, bonuses, salary increases for upper upper management ( many cashout their payments which keeps increasing in value) Businesses/wealthy invest in everything else but hiring, training, equipment. Banks and companies sitting on hundreds of billions in money. No loans or investments unless bubbles in housing, stocks and art count.

Congress refuses any extra spending, spending has remained frozen/cut for much of government (google sequester) Idiots.

Central bank (the Fed) knows all this. Cut rates to zero and gives increasing amounts of money to banks (quantitative easing) hoping bank will finally loan money. Still no loans. Plentiful credit cards.

0.01% get richer, we get shafted.

These are not normal times.

In the past governments could get more money into the crashing system by.

reducing taxes,

increasing spending on infrastructure,

or print for the banks to loan it out a lot and cheap

Then people/businesses invest, recession leaves hopefully.

Until 2008. Things changed.

The wealthy, and if corporations have been paying everless taxes seriously starting in the 1980s, income for most are flat at best, reversing for many ( if one has a job ), so no money by tax cuts.

Banks don't do 5% anymore they give out credit cards at 30% and hoard new money for stock buybacks, bonuses, salary increases for upper upper management ( many cashout their payments which keeps increasing in value) Businesses/wealthy invest in everything else but hiring, training, equipment. Banks and companies sitting on hundreds of billions in money. No loans or investments unless bubbles in housing, stocks and art count.

Congress refuses any extra spending, spending has remained frozen/cut for much of government (google sequester) Idiots.

Central bank (the Fed) knows all this. Cut rates to zero and gives increasing amounts of money to banks (quantitative easing) hoping bank will finally loan money. Still no loans. Plentiful credit cards.

0.01% get richer, we get shafted.

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

-

SuburbanFarmer

- Posts: 25440

- Joined: Wed Nov 30, 2016 6:50 am

- Location: Ohio

Re: Cheap Credit

Yep. Pretending that bank vaults will suddenly get overfilled and stimulate lending is the height of stupidity. Same as pretending that subsidizing insurance companies will make them charge less. Unbelievable.

-

jbird4049

- Posts: 1117

- Joined: Wed Nov 30, 2016 8:56 pm

Re: Cheap Credit

Oh I won't say that giving banks an almost unlimited amount of free money is the smartest tactic. The Fed is just going by past experience when doing so use to work.GrumpyCatFace wrote:Yep. Pretending that bank vaults will suddenly get overfilled and stimulate lending is the height of stupidity. Same as pretending that subsidizing insurance companies will make them charge less. Unbelievable.

Banks use to make most of their money by taking deposits, paying some interest for the privilege, and then loaning out the money at higher interest, making a profit on the difference.

Wall Street use to serve a need by giving those with money, investors, at place to invest in those with need, the individuals, businesses, and governments needed money to start, build, expand businesses, infrastructure, or things like wars.

It's a little oversimplified, and there has always been stupidity, greed, and corruption. Wall Street has always been like a gambling den. Still.

Straightforward. Functional, and useful, even necessary.

Giving banks free money meant that they would use the money to make more loans because that was how they made money then. These days banks try to avoid giving out loans, preferring credit cards, or tricks like service fees (Hello, Wells Fargo.), and so does Wall Street, which is still trying to create things like CDOs. Also, large businesses do not want to invest but rather pump up stock, bonuses, and salaries.

The banks, Wall Street, Corporations, and especially, the people who run them are all working the system to make money anyway they can, even if it means breaking the law, ignoring all sense of right and wrong. As a rule, the only thing that matters has become the enrichment of the upper management, regardless of the cost to everyone else.

Or to restating it, rather than being just a part of the system, stupidity, greed, and corruption. has become the system.

There are still good people, but they are trapped in the system. The lucky ones make a living, and romantically said perhaps, keeping part of their soul. The unlucky ones are destroyed, just like the Wells Fargo employees who were fired, and then blackballed from the banking industry either for fighting the corruption, or accepting the corruption and being convenient scapegoats for any investigations.

It reminds me of those of local, state, and federal governments, that are corrupt, and the police too. Plenty of people, maybe even a majority sometimes, want to do what's right, but if they try, they are destroyed. Just like those Wells Fargo employees, or governmental whistle-blowers.

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

-

SuburbanFarmer

- Posts: 25440

- Joined: Wed Nov 30, 2016 6:50 am

- Location: Ohio

Re: Cheap Credit

Well, then remove the incentive. No loans or credit over 15% interest. Watch it all turn.

-

jbird4049

- Posts: 1117

- Joined: Wed Nov 30, 2016 8:56 pm

Re: Cheap Credit

Agreed, but only our own corrupt Congress can do that. What are the chances of the current one doing so? They are some of the benefiting from it, albeit indirectly.GrumpyCatFace wrote:Well, then remove the incentive. No loans or credit over 15% interest. Watch it all turn.

Well, the Supreme Court could overturn its earlier 1978 ruling voiding the individual States' usury laws, which would help too.

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.